In 2013, the Client Monetary Protection Bureau discovered that the average payday borrower remained in debt for almost 200 days , turning a brief-time period crisis into an extended-term debt nightmare. As a revered dealer, do not charge any charges for looking our panel of old and new payday mortgage companies. You should repay the mortgage within 60 days of approval or by the top of the time period whichever is earlier. You can use a brief-term mortgage for almost something.

The assessment of your software is predicated on the present reimbursement affordability and therefore a payday loan turns into an accessible fund for the Students. Of course a true pal would always intend on paying the cash again even when it took some time period to take action. Annual Percentage Rates (APR), loan term and month-to-month payments are estimated primarily based on analysis of data provided by lenders and publicly out there info.

Nonetheless, amount for brief time period private loan is sort of debated between completely different lending companies. With short-time period loans, you’ve gotten the leisure of choosing a time period as per your personal circumstances. So avail it now with finest UK lenders accessible within the UK monetary market. It differs from one other type of short-term, high-rate debt referred to as a payday mortgage as a result of the borrower signs over the title of his or her automobile to safe the debt.

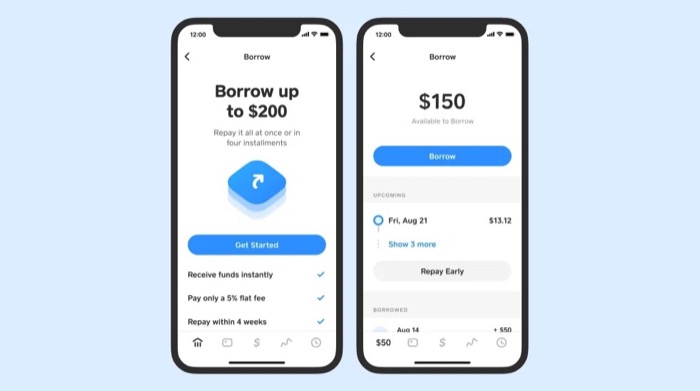

This aspect turns out to be useful for poor credit holders, as they will not have correct credit to position as a guarantee. Brigitis another app that helps handle your price range and offers cash advances to stretch your funds between paychecks. If you don’t have the funds out there, Dave can spot you a small advance. A traditional payday loan means you must repay the total value of the mortgage with your subsequent paycheck.

The members who borrow money from the credit score union pay curiosity on their loan (like rent for using the cash). When you borrow these interest-free funds, you’ll be anticipated to repay the loan as soon as your subsequent paycheck is deposited. Short-term loans is usually a useful financial solution for a variety of situations. Most lenders perform no onerous credit verify to keep away from damaging your credit history.

At Sunny, our brief-time period loans include a number of advantages that may make repaying what you’ve borrowed simple and stress-free. Use Credible to easily examine personal loan charges all in one place. Make flexible month-to-month repayments on-line. Interest rates are normally decrease than business loans. Taking out a payday loan is never a good idea should you can avoid it. And if they balk at providing you an EPP, be certain to level out the agency’s finest practices in relation to working with clients on repaying loans.

But they could also be value contemplating if you’re on the lookout for a short-term loan. For questions pertaining to your loan software status, you must contact your assigned lender directly. Use Credible to information you through the net loan software course of and evaluate loan rates from multiple lenders. These days, though, the short-time period loans which are often also referred to as payday loans can be repaid over numerous weeks or even months.

Has trusted connections with noteworthy lenders who provide poor credit loans with guaranteed approval. Debtors can’t touch the money in their account in the course of the loan. As the name suggests, a short-term loan is a small short Term loans personal loan taken for a short interval with no collateral backing up the loan.

Has trusted connections with noteworthy lenders who provide poor credit loans with guaranteed approval. Debtors can’t touch the money in their account in the course of the loan. As the name suggests, a short-term loan is a small short Term loans personal loan taken for a short interval with no collateral backing up the loan.